33 trillion cubic feet.

That’s how much natural gas drillers extracted in the United States last year… every day!

And it all started 193 years ago along the Canadaway Creek in Fredonia, New York.

That’s when a gunsmith by the name of William Hart drilled a 27-foot hole into the ground and kick-started our country’s natural gas industry.

After striking out twice already, his third well hit pay dirt and became the United States’ first commercial gas well.

I guess the third time really is the charm.

We’ve also come a long way since “the father of natural gas” sunk his first gas well.

Granted, had I told you more than a decade ago that the U.S. would be a powerhouse natural gas producer, you probably would’ve laughed me out of the room.

Back then, we were in a much different situation, and natural gas prices were very volatile. Some of my veteran readers will probably remember when Hurricanes Rita and Katrina drove prices higher to top more than $15 per Mcf in 2005.

In 2008, Hurricanes Gustav and Ike pushed prices above $12.50 per Mcf.

What most investors didn’t realize, however, is that in 2004, a little-known company by the name of Range Resources drilled its now-famous Renz #1 well into the Marcellus Shale.

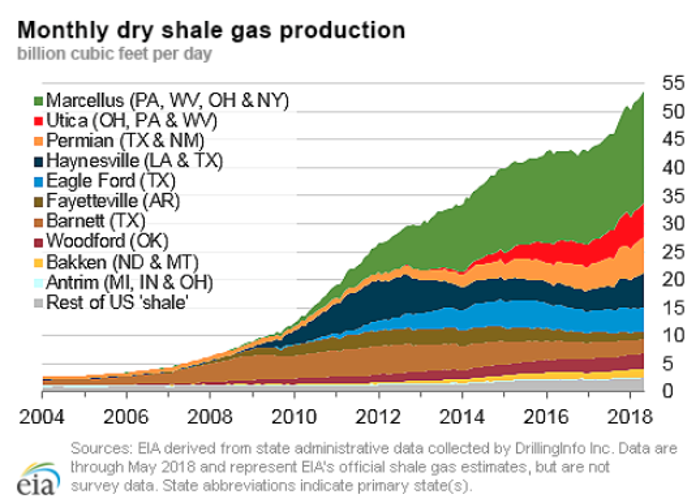

You can see for yourself how that turned out for them:

Today, Marcellus production accounts for roughly 30% of the United States’ natural gas production.

And it couldn’t have come at a better time for us.

Let’s be fair here; to say that the U.S. has become a powerhouse natural gas producer would be a gross understatement.

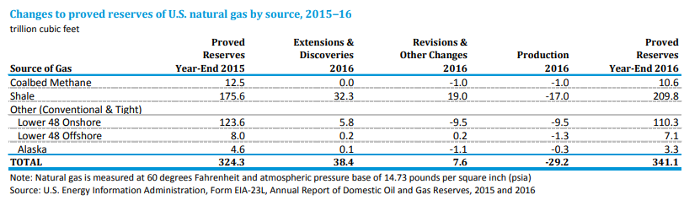

According to the numbers at the EIA, the U.S. had an eye-popping 341.1 trillion cubic feet of proved natural gas reserves at the end of 2016.

But let’s put a little more perspective on this, shall we?

Investors need to truly grasp how important our shale gas is to the industry.

At last count, shale gas accounted for nearly 62% of the United States’ proved reserves:

You can get a sense of how vital shale gas is, right? Thanks to plays like the Marcellus, our proved reserves of natural gas — which have been steadily declining for decades — are at a point that we haven’t seen since the mid-1970s!

If you look close enough, it’s impossible to miss the opportunity shaping up as you read this…

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Tapping into Hart’s Trillion-Dollar Legacy

Perhaps the biggest drawback to the shale gas boom has been the supply that has flooded the U.S.

That glut has taken a devastating toll on domestic prices.

And even though storage levels have fallen well below the five-year average, natural gas prices have failed to find support above $3 per Mcf for long over the last 12 months.

Normally, that would be cause for concern.

After all, it’s never good to watch prices plummet when you have some skin in the drillers that are pumping the gas out of the ground.

In the past, there’d be even more concern due to the fact that natural gas markets are traditionally regional.

All of that has changed.

Today, the United States is quickly becoming a major player for natural gas exports.

It turns out our neighbors are developing quite a taste for U.S. natural gas.

Since the first commercial well was drilled into the Marcellus, our exports to Mexico have more than tripled. In 2017, we sent Mexico a record 1.5 trillion cubic feet of natural gas.

Of course, we can’t forget the elephant in the room: Asia.

I know some of you might be thinking that tapping into the Asian LNG market sounds like a logistical nightmare.

That’s not the case today, and it’s all thanks to a little project that expanded the width of the Panama Canal to 180 feet.

Now, approximately 90% of LNG tankers can fit through the Panama Canal, and it’s the key that has unlocked a fortune for the U.S. LNG trade.

That alone is worth our attention and due diligence.

Going forward, we’re going to delve into a few of the specific players taking full advantage of this situation.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.